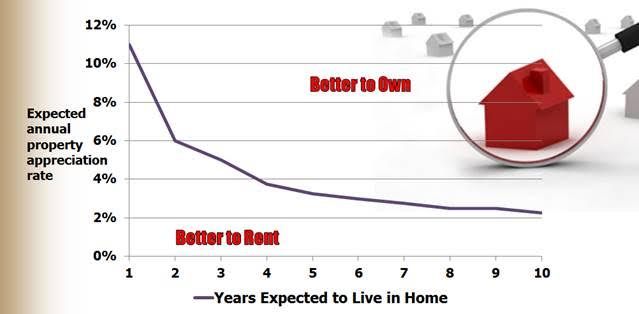

Whether it is better to rent or own a home partly depends on your long term plans and how property prices are moving. The more quickly prices escalate, and the longer you plan to live there, the better the argument for owning. The chart above is a useful guide for gauging at what point purchasing a home makes sense.

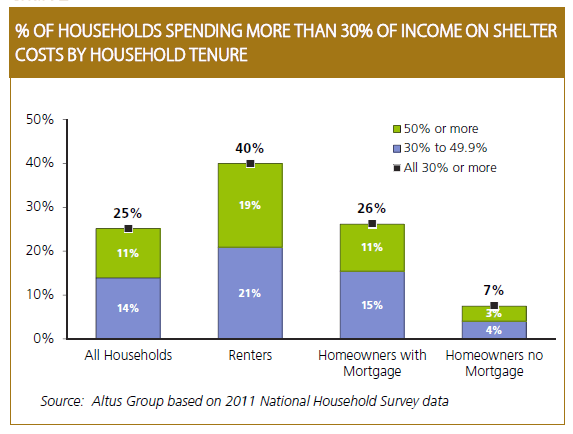

Have a look at the chart below. It seems to suggest that owning a home (with mortgage) is actually more cost effective than renting.

I often see news stories about the high cost that Canadians are paying for shelter (when viewed as a percentage of their annual income). Many people have used this to suggest that property values are inflated and a market correction is imminent. The idea is that buyers simply will stop paying so much for homes and presumably rent instead. However, that argument may not hold up to scrutiny. This is because Canadians renters, on average, are paying more of their annual income for shelter than their counterparts holding a mortgage. And those renters are, of course, helping to pay for the mortgages of their landlords. So, unless and until people stop both buying AND renting, property values will not necessarily adjust based on percentage of household income. Now, I’m not saying that it’s good and right that property values are where they are at. I’m simply saying that we can’t assume property values will go down because of this.

Let’s run through some assumptions…

The value of rental properties will go up or down based on the income they can produce for the owners. In an area of low rents (low demand) property values will be lower, in an area of high rents (high demand), property values will be higher. (Capitalization Rate)

Cost of rent at any given point in time is often cheaper than the initial cost of mortgage payments at that same point in time.

Rent tends to go up over time. (Inflation)

Ongoing mortgage payments pay down your principle and increase your home equity over time. (Investment)

Property values tend to go up over time. (Inflation)

According to this chart, it appears that renters are actually spending a higher proportion of their income on shelter than homeowners. 40% of renters are paying over 50% of their annual income for shelter. Only 26% of homeowners (with mortgage) are paying over 50% of their annual income for shelter. So, while the cost of owning a home is very likely to represent a higher proportion of annual income initially, over time this number should come down and, over the long run, it appears that home ownership is the better way to go.

I welcome your thoughts and comments.

The value of rental properties will go up or down based on the income they can produce for the owners. In an area of low rents (low demand) property values will be lower, in an area of high rents (high demand), property values will be higher. (Capitalization Rate)

Cost of rent at any given point in time is often cheaper than the initial cost of mortgage payments at that same point in time.

Rent tends to go up over time. (Inflation)

Ongoing mortgage payments pay down your principle and increase your home equity over time. (Investment)

Property values tend to go up over time. (Inflation)

According to this chart, it appears that renters are actually spending a higher proportion of their income on shelter than homeowners. 40% of renters are paying over 50% of their annual income for shelter. Only 26% of homeowners (with mortgage) are paying over 50% of their annual income for shelter. So, while the cost of owning a home is very likely to represent a higher proportion of annual income initially, over time this number should come down and, over the long run, it appears that home ownership is the better way to go.

I welcome your thoughts and comments.